| Verifying Division Orders | Practice Areas | Cases | Fees | Contact | About |

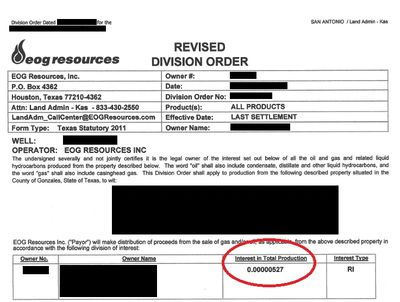

How to Verify Your Division OrderBefore issuing payments, most oil companies require landowners to sign division orders like the one pictured here. Every division order has the name of the oil company, the name of the landowner, a property description, and a decimal with eight decimal places. This decimal is called a "Division Order Interest" or "DOI." In the pictured division order, the DOI is 0.00000527. The landowner with this DOI receives $0.00000527 for every $1 in oil and gas produced from the wells covering the land. To determine whether the landowner is being paid correctly, an oil and gas lawyer has to reverse engineer the DOI and figure out how the oil company came up with 0.00000527. Suppose a landowner owned all the minerals under his land. If he signed an oil and gas lease with a 1/4 royalty, his DOI would be 0.25000000. If he owned 1/2 of the minerals and signed an oil and gas lease with a 1/4 royalty, his DOI would be 0.12500000. The interest in the land multiplied by the royalty in the lease equals the DOI. Unfortunately, it's rarely that simple. Oil companies often drill wells across property lines. Suppose a landowner owned all the minerals under his land, signed an oil and gas lease with a 1/4 royalty, and the oil company drilled a well that is half on his land and half on his neighbor's land. Combining land is called pooling. The combined acreage is called a pooled unit. In this scenario, his DOI would be 0.12500000. The interest in the land multiplied by the royalty in the lease multiplied by the acreage in the pooled unit equals the DOI. Minerals are often burdened by a nonparticipating royalty interest or "NPRI." An NPRI is a right to receive royalty payments which would otherwise be owned by the mineral owner. NPRIs can be "fixed" or "floating." A fixed NPRI is a designated fraction of whatever comes out of the ground. A floating NPRI changes with the royalty in the underlying oil and gas lease. For example, a floating 1/16 NPRI owner will receive 1/16 of 1/4 under an oil and gas lease with a 1/4 royalty. He will receive 1/16 of 1/5 under an oil and gas lease with a 1/5 royalty. A fixed 1/16 NPRI owner will receive 1/16 regardless of the royalty in the underlying oil and gas lease. Suppose a landowner owned all the minerals under his land, signed an oil and gas lease with a 1/4 royalty, and the oil company drilled a well that is half on his land and half on his neighbor's land. Suppose further the landowner's minerals were subject to a floating 1/2 NPRI. In this scenario, his DOI would be 0.06250000. The interest in the land multiplied by the royalty in the lease multiplied by the acreage in the pooled unit, less the NPRI burdens, equals the DOI. In the pictured division order, the landowner owns 5.311875% of the minerals in several hundred acres of land. His minerals are subject to an oil and gas lease with a 1/5 royalty. His minerals are also subject to a floating 1/2 non-participating royalty interest. The oil company pooled 1.15 acres of his land with 1,166.18 acres of neighboring property. This DOI is calculated as follows: 5.311875% x 1/5 x 1/2 x 1.15/1,166.18 = 0.00000524. The difference in this case is a rounding error, which is immaterial at the 8th decimal place. It's very difficult to figure out whether you're being paid correctly based on the DOI alone. Determining your exact mineral or royalty interest requires an oil and gas attorney. This is because a few words in a single deed can drastically change the above numbers. A deed selling "1/8 royalty" creates a fixed NPRI. A deed selling "1/8 of the royalty" creates a floating NPRI. A deed selling "1/8 of 1/8 royalty" creates a floating NPRI. Under current Texas law, 1/8 of 1/8 is not 1/64 unless the underlying oil and gas lease has a 1/8 royalty. This counterintuitive example is just one of the many ways deeds can be misinterpreted. It's easy to get it wrong. Getting it right requires an oil and gas attorney. |

|

Bold labels are required.

Abilene Office

BBVA Compass Bank Building

1049 N. 3rd St

Suite 200

Abilene, Texas 79601

Phone :325-691-0370

Fax: 325-692-8107

Map & Directions